Complete Feature Overview

Everything you need for professional cryptocurrency tax calculations

PrivateACB unifies your entire cryptocurrency trading history into a single encrypted database, regardless of how many exchanges or platforms you've used.

The platform automatically imports transaction files from any source and reconciles different CSV formats, multiple currencies, and varying date conventions into one unified record. Our classification engine recognizes 60+ transaction types and instantly categorizes each into the correct tax treatment (Exchange, Income, Transfer, or DeFi). No manual tagging required.

Stop managing spreadsheets, manually categorizing transactions, and trusting cloud services with your private financial data. PrivateACB consolidates fragmented records across platforms and delivers tax-ready calculations automatically—all on your computer.

Core Tax Calculation Engine

Accurate calculations following CRA and IRS guidelines

Canadian ACB Calculations

Fully compliant with Canada Revenue Agency requirements

- ACB method per CRA guidelines

- Superficial loss rule detection

- ACB pool management

- Multi-currency ACB support

- Schedule 3 & T1135 export

US Cost Basis Calculations

IRS-compliant methods for all scenarios

- FIFO, LIFO, and HIFO methods

- Specific ID method (Coming Q3 2026)

- Optional wash sale detection (enable when IRS rules apply to crypto)

- Tax lot management & tracking

- Form 8949 & Schedule D export

- Short vs long-term classification

12 Specialized Tax Reports

Detailed reports to help prepare your tax filings

Canadian Reports

CRA-focused documentation

- Schedule 3 - Capital Gains

- T1135 - Foreign Property Report

- ACB Summary by Asset

- Superficial Loss Report

- Income Report (staking, mining, rewards)

- Tax Audit Summary

US Reports

IRS-focused documentation

- Form 8949 - Capital Gains/Losses

- Schedule D - Summary

- Tax Lot Inventory

- Wash Sale Report

- Income Report (staking, mining, rewards)

- Tax Audit Summary

Export Options

Professional output formats

- PDF export with optional branding

- CSV export for spreadsheets

- View full reports in-app during trial

- Interactive charts and visualizations

- Method comparison analysis

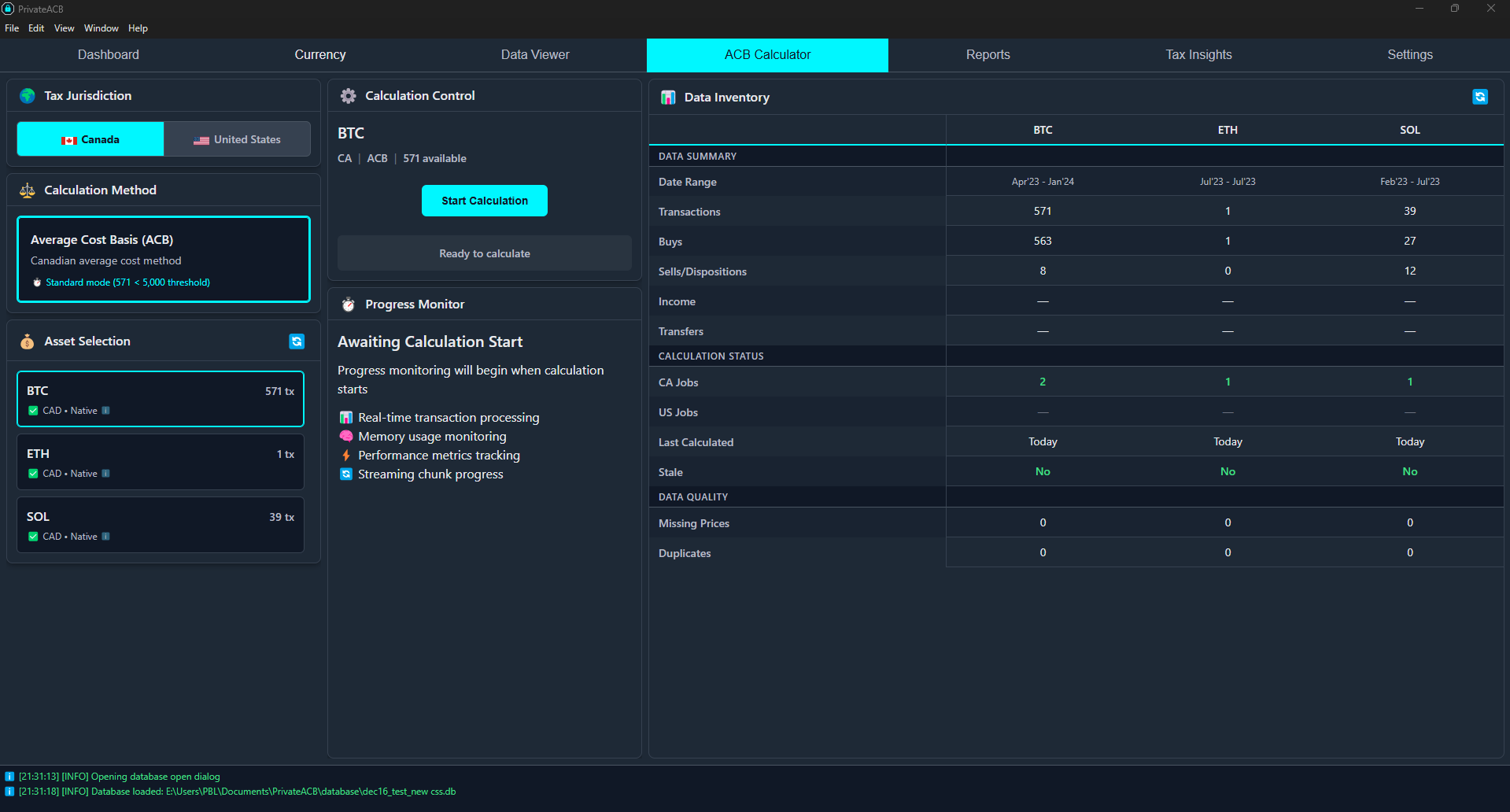

See It In Action

Professional calculation interface with detailed breakdown

Privacy & Security Architecture

Bank-grade security with zero cloud exposure

Local-Only Processing

Your data never leaves your computer

- 100% local calculations

- No account required

- Zero telemetry

- Offline capable

- You own your data

Military-Grade Encryption

Bank-level security for your financial data

- AES-256 encryption

- SQLCipher database

- Encrypted key management

- Memory protection

- Secure architecture

Data Integrity

Protection against data corruption

- Atomic transactions

- Backup integration

- Import history tracking

- Validation layers

- Hash-based duplicate detection

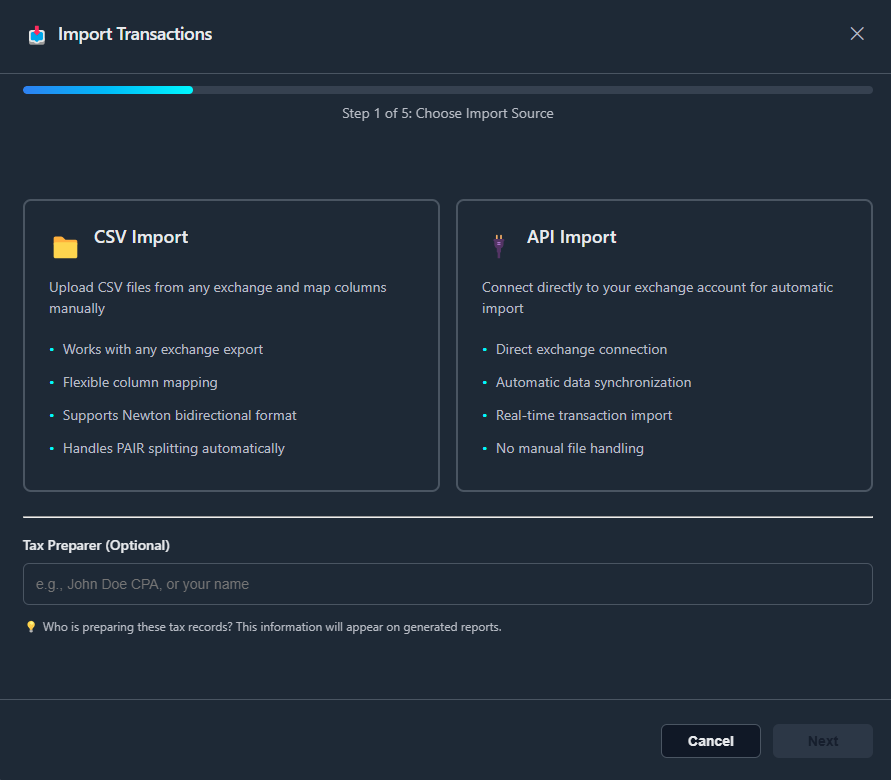

Data Import & Integration

Flexible import options for all your exchanges

CSV Import (All Editions)

Import from 8+ exchange formats

- Coinbase, Binance, Kraken, NDAX

- Newton, Shakepay, Gemini

- Generic CSV format

- Smart format auto-detection

- Hash-based duplicate detection

- 3-tier validation (blocking/warning/info)

- Exportable error report CSV with row numbers

CoinGecko Price Fetching

Automatic historical price data for income valuation

- Top 100 cryptocurrencies supported

- Historical prices for any date

- Automatic income conversion (staking, airdrops, rewards)

- Bulk fetch for all missing prices

- Manual entry fallback option

- CSV price import available

API Import (Pro Only)Q3 2026

Direct integration for automated sync

- 🚀 Coinbase direct sync

- Secure credential management

- Skip manual CSV downloads

- Future: Kraken & Binance

Enterprise-Grade Performance

Built to handle professional-scale portfolios

High Performance

Built for large portfolios

- 100,000+ transactions supported

- Streaming calculation engine

- Configurable chunk size & memory limits

- Background calculations

- User-adjustable performance settings

Smart Processing

Intelligent handling of complex scenarios

- Resume interrupted calculations

- Incremental updates

- Progress tracking with performance metrics

- Context-aware performance grading

- Real-time status bar feedback

- Session log files for troubleshooting

- Permanent events table (encrypted)

- Batch operations

Data Management & Settings

Full control over your data and calculations

Data Inventory Dashboard

At-a-glance view of your entire portfolio

- Per-asset transaction summary

- Date ranges and transaction counts

- Calculation status indicators

- Data quality checks (missing prices, duplicates)

- Stale calculation warnings

Database Management

Complete control over your data

- Database backup and restore

- Multi-currency support (CAD, USD)

- Bank of Canada & Federal Reserve API integration

- Tax method configuration

- Performance tuning settings

Interactive Visualizations

Understand your tax situation at a glance

- Tax method comparison charts

- Gain/loss analysis over time

- ACB progression tracking

- Superficial loss impact visualization

- Income breakdown by type

Professional Features

Advanced capabilities for Pro editions

Custom PDF BrandingQ1 2026

Add your business branding to reports

- Custom business logo

- Contact information

- Professional presentation

- Client-ready reports

- Perfect for tax professionals

Priority Support

Faster response times for Pro users

- Priority email support

- Faster response times

- 2 years of updates (vs 1 year)

- Early access to features

- Direct developer feedback

Standard vs Pro Edition

Choose the right edition for your needs

| Feature | Standard | Pro |

|---|---|---|

| Tax Calculations | ✓ All methods | ✓ All methods |

| CSV Import | ✓ 8+ exchanges | ✓ 8+ exchanges |

| API Import | — | 🚀 Coming Q3 2026 |

| PDF Branding | — | 🚀 Coming Q1 2026 |

| Transactions | Unlimited | Unlimited |

| Support | Email (standard) | Email (priority) |

| Updates | 1 Year | 2 Years |

| Price (Canada/US) | $39 | $49 |

| Price (Both) | $69 | $79 |

Ready to Experience Professional-Grade Crypto Tax Software?

Download your free 30-day trial and see why traders choose PrivateACB