Privacy-First

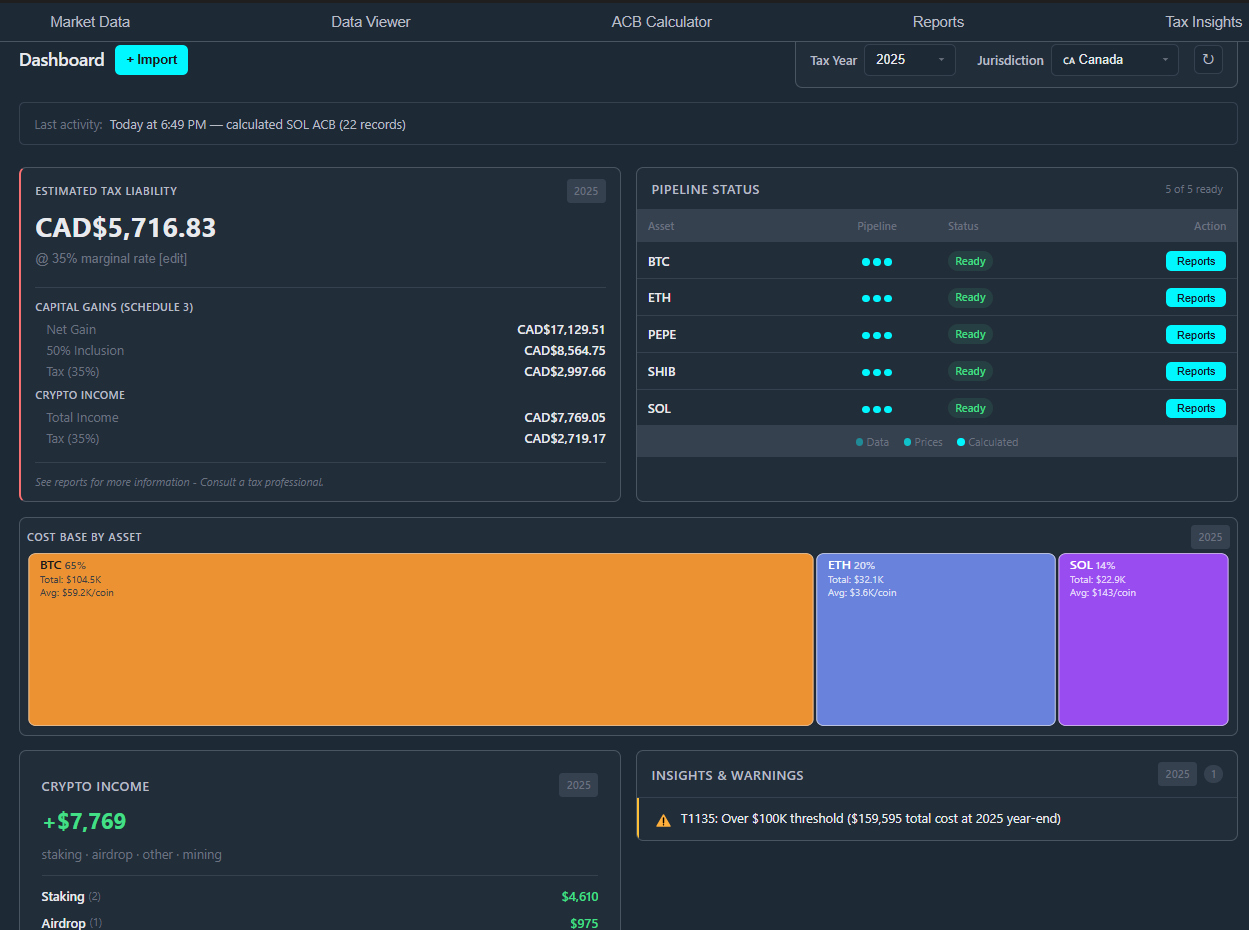

Crypto Tax Software

Runs locally. Never uploads. Never shared.

Professional calculations.

Full features • View all reports • No credit card required